After gaining a solid foothold in the faux-beef market, alternative meat companies have their sights clearly set on gaining a slice of the chicken market. Beyond Meat and Impossible Foods, the two leading plant-based meat companies, both have new lines of chicken products hitting the market. Beyond Chicken Tenders are in hundreds of restaurants already, including Panda Express, where a special “Beyond Orange Chicken” is now featured on the menu. Impossible’s chicken nuggets are set to be in restaurants this fall. Tyson. the largest U.S. broiler producer, has plant-based chicken nuggets and tenders already in stores under its Raised & Rooted line. Meanwhile Nestlé, the world’s largest food company, also has soy-based chicken options in grocery stores and is now working on a cultivated-cell/plant-based hybrid.

According to statistics from market analysis provider SPINS, plant-based chicken is growing at a rate of +18%. Ryan Riddle, senior product development specialist for Nestlé’s plant-based meal solutions, says that even before the pandemic-which made consumers even more health conscious-chicken was the most popular meat in America, accounting for 45% of meat consumption. He also says that the main reason consumers give for trying plant-based meat alternatives is their health. These factors, according to Riddle, make this the perfect time to roll out new alt-chicken products.

Chicken’s healthier image is credited with helping it surpass both beef and pork consumption in the U.S., with Americans eating an average of 97.6 pounds of chicken in 2020. That’s more than double the average of 40.1 pounds in 1980. Industry experts say that faux-chicken could muscle its way into a greater share of the traditional poultry market if brands can successfully convince consumers that the fake stuff is an even healthier option than the real thing. Interestingly, the plant-based alternatives so far are mostly pre-cooked breaded products like nuggets, tenders, and patties, though there are an increasing number of “grilled” options.

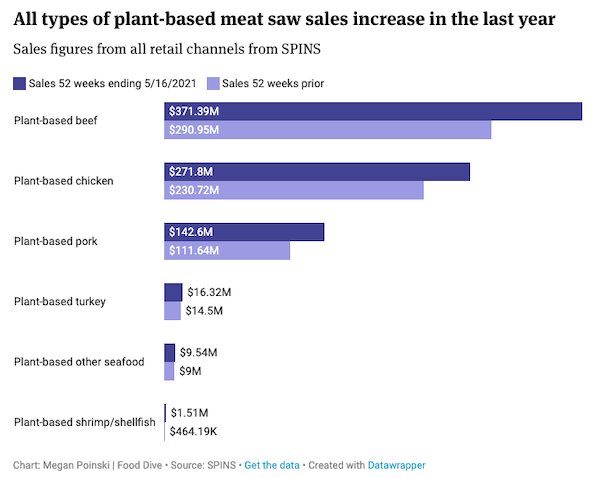

Jeff Crumpton, a SPINS retail business consultant, says chicken alternatives are the second most consumed plant-based meat product category today, behind faux-beef burgers. Nuggets are the top seller, with plant-based alternative sales climbing almost +50%. Sam Terris, co-founder and chief operating officer of plant-based chicken company Simulate, explains, “I think you can kind of convince anyone to eat a plant-based chicken nugget…whereas if you’re trying to simulate filet mignon, people have these kind of extremely high expectations.”

Alt-chicken products currently on the market are mostly made with protein derived from pea, soy, or fava beans. There is not one standardized production technique or “recipe”, but overall it sounds like it is easier to simulate real chicken than beef. That’s partially due to the “bleeding” and browning properties of beef that is hard to duplicate. Some say that it is also the result of breakthroughs already made by alternative-beef producers, which have also helped pave the way for consumer acceptance.

Many of the alternative chicken products have the added feature of being highly convenient. Nestlé’s Mindful Chik’n, for instance, requires no cooking or thawing. The plain, pre-cooked “chicken” chunks or shreds can be stored in the fridge and used cold in things like salads or sandwiches. They can also be added to hot meals, require nothing more than a few minutes of heating straight out of the bag. They even have pre-seasoned offerings like Korean BBQ and Chipotle.

Nestlé’s next big alternative-chicken innovation looks like it will involve cultured protein, also referred to as cell-based or “lab-grown”. Cultured meat is made from real animal cells which are given nutrients to grow muscle and fat. According to Bloomberg, Nestlé is currently working with Future Meat to blend its cultured protein with plant-based ingredients. Some industry insiders think that Nestlé’s collaboration on Future Meat’s cell-based meat could rapidly help lower the cost of cellular production. Most current projections show that cultivated meat won’t reach cost-parity with traditional meat until around 2030 or beyond.

Data from The Good Food Institute (GFI), an alternative protein advocacy group, show investments in plant-based, cell cultivated and fermented protein companies reached $3.1 billion in 2020, significantly higher than in 2019, when investment levels were near $1 billion. (Sources: FoodDive, WattPoultry, CrunchBase)

Demand for poultry meat and eggs is expected to continue increasing due to population growth and rising individual consumption. The market for poultry meat is projected to increase regardless of region or income level, with per capita growth slightly higher in developing than in developed regions.