Pastureland conditions this year are off to the worst start for the grazing season since the U.S. Department of Agriculture (USDA) began keeping track in 1995. The terrible conditions are the result of the prolonged drought across the country, with about half the U.S. cattle herd within an area experiencing some level of drought. As a result, producers are pushing cattle into feedlots at a breakneck pace, setting up a possible shortage of cattle available for slaughter later in 2022 and 2023.

USDA’s latest “Livestock, Poultry and Dairy Outlook” says two years of drought have deteriorated pasture and forage conditions. At the same time, rising costs for fuel, grain and other inputs are expected to add +$75 to the cost of producing a calf this year, according to USDA estimates. The U.S. beef cow inventory at the start of 2022 was just a little over +1 million higher than the 2014 drought-induced record low of 29.085 million.

The ongoing drought combined with higher operating costs are now encouraging an unseasonably rapid culling of beef cows in first-quarter 2022 to levels not seen in decades. In fact, beef slaughter in April 2022 was the highest number on record for the month since 1996. USDA also points out that the U.S. in 1996 had some +5 million more beef cows than it did at the start of 2022. Bottom line, the numbers suggest smaller calf crops this year and next, as well as lower placements later this year and in 2023.

The impact of the drought on the cattle marketing cycle resulted in a +132 million pound increase in USDA’s forecast for 2022 beef production. As more calves are placed in feedlots sooner than normally expected, this also changes the outlook for 2023 with production now expected to decline nearly -7% from 2022 to around 26 billion pounds, versus an estimated 27.8 billion pounds in 2022. If realized, it would mark the second year of lower production following the record set in 2021. While estimated production in 2022 is only fractionally lower than 2021 at this point, 2023’s estimated output is the lowest since 2016.

Fed cattle prices this year are projected to remain mostly restrained due to the higher-than-normal number of cattle-on-feed, but they are expected to more than recover in 2023, possibly approaching the record levels set in 2014. USDA raised its outlook for Q3 2022 fed cattle prices by +$1 but lowered Q4 prices by -$2, for an annual forecast of $162.80 per hundredweight (cwt), which is about -$0.20 lower than last month’s forecast. In 2023, USDA expects prices to climb +$35 to $198.00 per cwt, or +22% higher than the projection for 2022. Based on the April 2022 average monthly fed steer price of $141.66 per cwt and current price data, the full-year 2022 fed steer price is forecast at $140.1 per ct. The 2023 price is seen increasing +$13 to $153.00 per cwt, the highest since 2014.

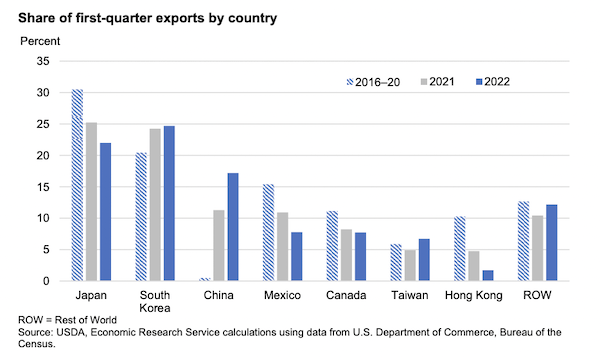

As for U.S. beef trade, Q1 2022 was a record for exports, totaling 846 million pounds, or +6% higher than a year ago and +16% above the 5-year average. March beef exports actually hit a record for the month, and were the third-highest for any month on record. Exports for full-year 2022 are seen rising a little over +6% from last year thanks to the higher production levels. However, due to the plunge in beef production in 2023, exports are expected to plunge by about -13%.

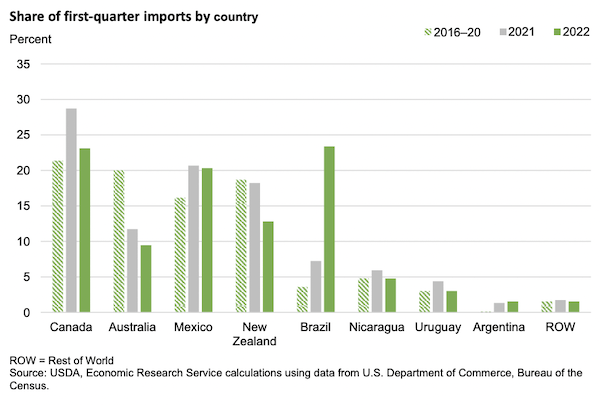

Meanwhile, Q1 beef imports also hit a new record climbing a whopping +41% year-over-year and +36% higher than the 5-year average. Imports are expected to increase to 3.545 billion pounds in 2022, then dip by -10% in 2023 to around 3.2 billion pounds. The full report is HERE.