US farmers are once again facing rising fertilizer prices after a brief period of stabilization following disruptions tied to the pandemic and Russia’s invasion of Ukraine. While prices for fertilizers remain below the record highs set in 2022, the elevated costs are nonetheless taking a bite out of already stretched farm budgets.

The biggest price pressures are being felt in phosphate fertilizers. The price of DAP jumped +5% during the first week of September alone. According to prices tracked by Progressive Farmer/DTN, all 8 primary fertilizers used by US farmers are higher compared to last year, with DAP up +16% as of the first week of September, while MAP has gained +12%, anhydrous is up +14%, UAN 28 is up +27%, urea is up +29%, and UAN32 is more than +32% more expensive.

Potash (+1%) and 10-34-0 (+5%) are the only fertilizers tracked by DTN that have not seen double-digit price jumps compared to last year at this same time. However, prices for these two fertilizers were even weaker at the start of the year, so year-over-year comparisons don’t capture the extent of recent gains. Since the final week of December 2024, potash prices are nearly +10% higher and 10-34-0 is just over +8% higher.

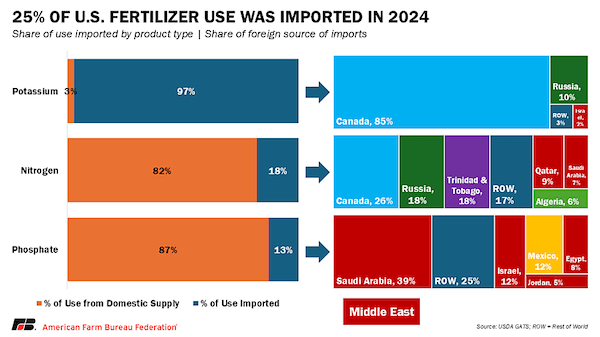

American Farm Bureau Federation (AFBF) economist Faith Parum says trade and policy pressures, including export restrictions out of China, new tariffs in the European Union, and U.S. tariff action on Canadian potash, are reshaping markets. “The big drivers are energy costs, mainly because nitrogen fertilizers rely on natural gas and so other countries have had decreased production due to conflict, as well as geopolitical disputes overall,” Parum said.

Nitrogen supplies have been particularly affected by global trade policy, most notably China’s discretionary export restrictions. In 2024, China’s nitrogen fertilizer exports fell by more than -90% (y/y), as authorities prioritized stabilizing domestic prices and securing supplies for domestic agricultural production, according to World Bank. These restrictions remained in place well into 2025.

China’s phosphate exports have also been curbed to ensure availability for lithium iron phosphate batteries used in electric vehicles. Meanwhile, Belarus—primarily a key potash exporter—continues to face trade restrictions imposed by the European Union.

For nitrogen, natural gas supply (which is a key component in nitrogen fertilizer) remains the critical bottleneck, according to AFBF. In the US, natural gas prices are projected to rise into late 2025 and 2026 as liquefied natural gas export capacity grows. That means the baseline cost of producing ammonia, urea, and UAN is higher than it was in early 2024, when gas was relatively cheap.

More recently, the EU introduced tariffs on remaining agricultural imports, including nitrogen-based fertilizers from both Russia and Belarus. These tariffs, to be phased in over three years, are designed to reduce the EU’s reliance on these suppliers and constrain Russia’s export revenues. The move is shifting global supply chains in the meantime and putting upward pressure on world prices.

AFBF points out that UAN prices in the US vary widely by region, with tighter supplies in areas farther from production hubs and import terminals, while regions closer to key river or rail transport routes have had more consistent availability. Parum said these swings highlight how quickly nitrogen prices can change in response to global trade and natural gas markets.

The combination of higher expenses and weaker crop revenues is expected to weigh on overall net farm income, particularly for row crop farmers, says Parum. Fertilizer remains one of the largest and most volatile expenses for crop production, meaning even modest swings in price can alter the outlook for profitability.

“The combined effect of higher expenses and lower revenues is contributing to warnings of stress in the farm economy,” she said. “Even though conditions differ across regions and commodities, the overarching pattern is clear: farmers are entering another year in which volatile markets and tight, or negative, margins reduce their ability to accommodate rising costs.” (Sources: DTN, American Farm Bureau Federation (AFBF), World Bank, Platts)