Higher commodity prices are contributing to a sharp increase in U.S. net farm income in 2021 that is expected to reach the highest levels since 2013, according to the latest updates from the University of Missouri’s Food & Agriculture Policy Research Institute (FAPRI). Unfortunately, FAPRI sees farm income declining in 2022 due largely to reduced government payments and rising input prices. Below are more details on FAPRI’s latest forecasts for 2022 and beyond. The projections cover fiscal year (FY) periods, which begin on Oct. 1 (FY2022 = Oct. 1, 2021 to Sep. 30, 2022). FAPRI’s Baseline Farm Income report is HERE.

Net Farm Income: FAPRI pegs total FY2022 net farm income at $99.3 billion, a decline of -$23 billion from $122.3 billion in fiscal year 2021, the highest since 2013. A $22-billion drop in direct payments in 2022 from this year’s level will account for nearly all of the projected -19% decline in net farm income. Beyond 2022, projected net farm income remains fairly steady in nominal terms at around $91 – $93 billion, which remains far above 2019’s $79.1 billion. Adjusted for inflation, net farm income in 2022 is slightly lower at $96.1 billion, with subsequent years each witnessing declines but remaining above $82 billion.

Government Payments: FAPRI projects total government spending on farm-related programs will fall to $21.6 billion in FY2022, a decline of -$30.6 billion from FY2021’s record $52.2 billion. The majority of the decline stems from pandemic-related payments which are forecast to only total $2 billion in FY2022 versus a whopping $20.8 billion in FY2021. Spending on 2018 Farm Bill commodity programs and other CCC (Commodity Credit Corporation) funded payments will total almost $6 billion in FY 2022, down from over $10 billion the previous year. Direct government payments in FY2022 are estimated at $6.2 billion versus $28.3 billion in FY2021 and $45.7 billion in FY2020.

Farm Production Expenses: FAPRI expects higher costs for feed, purchased livestock, fertilizer, and other farm inputs to raise farm production expenses by nearly +$13 billion to $397.6 billion in FY2022 after rising +$27 billion to $384.7 billion in FY2021. The biggest increases include fertilizer and chemicals, which rises to $46.8 billion in FY2022 from $43.3 billion in FY2021; and fuels and electricity, which increase to $21.6 billion from $19.7 billion. The only farm expense forecast to decline in FY2022 is feed, pegged at $68.2 billion in FY200 versus $69.4 billion in FY2021.

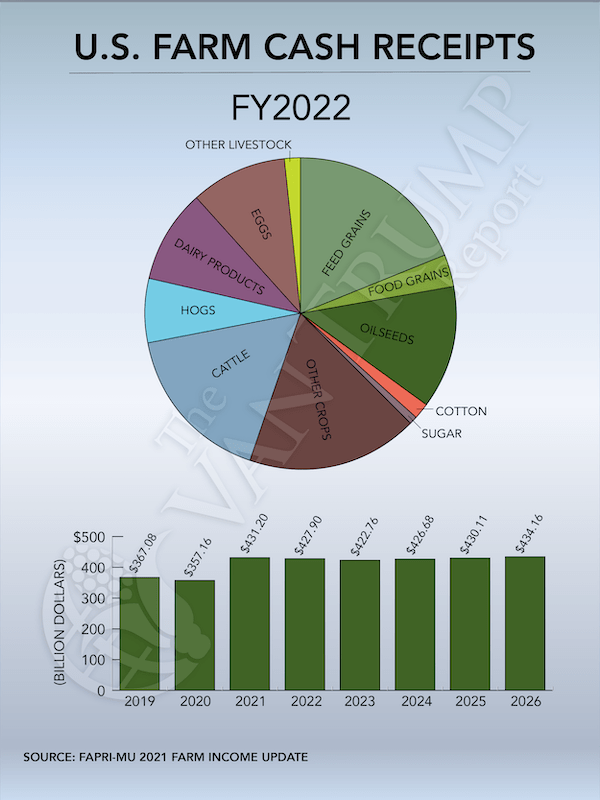

Baseline Crop Prices: The big takeaway from FAPRI’s Baseline Updates for farm cash receipts is that farm prices and subsequent gross market revenue for corn, soybeans, and wheat are all projected to peak in 2021/22. However, the lower prices are expected to remain well above 2019/20 levels. Total farm receipts in FY2022 are forecast at $467.6 billion, down only slightly from $468.1 billion in FY2021. The breakdowns include FY2022 crop receipts at $237.7 billion versus $239.5 billion in 2021; livestock receipts of $190.2 billion versus $191.7 billion; and farm-related receipts of $39.7 billion versus $36.9 billion. FAPRI’s latest Baseline Update for U.S. Agricultural Markets is HERE.

CORN – FAPRI notes that a strong large increase in imports by China, reduced production in Brazil, and other factors increase the projected marketing-year-average (MYA) corn price to $5.34 per bushel for the crop harvested this fall. If realized, it would be the highest annual U.S. corn price since the 2012 drought year. FAPRI adds that corn prices could fall in subsequent years as Brazilian production rebounds, China’s imports stabilize, and domestic corn use grows at only a modest pace. Currently, projected corn farm prices remain above $4.00 per bushel over the next five years.

SOYBEANS – FAPRI says recent and expansion in renewable diesel capacity and production, partly in response to California’s low-carbon fuel standard, has contributed to a large increase in soybean oil prices. This also supports soybean prices, but puts downward pressure on prices for soybean meal. Projected MYA soybean prices increase to $13.18 per bushel in the current 2021/22 marketing year, but then moderate as global markets respond. Prices stay above $11.00 per bushel through 2026/27.

WHEAT – Weather-related crop reductions will push up wheat prices in 2021/22, with the farm price pegged at $6.31 vs $5.05 in 2020/21. As with corn and soybeans, prices are expected to decline in subsequent years but are seen remaining above the $5.50 level through 2026/27.