Soybean producers in Argentina have had a rough growing season with the La Niña weather pattern bringing both too much and too little moisture. Similar to the same trends seen across Brazil, the Southern Hemisphere’s winter and spring brought overly dry conditions that delayed planting and development of Argentina’s oilseed crops. Things looked like they were turning around with above-average rainfall in January, but that hope was short-lived.

Mostly as a result of drought returning to the country, USDA’s Foreign Agricultural Service’s Buenos Aires Post has reduced its estimate for Argentina’s 2020/21 soybean production by -2.5 million metric tons from its previous forecast in February. The new forecast of 45 million metric tons is also -2.5 million less than the USDA’s current estimate of 47.5 million metric tons. Both are higher than the Buenos Aires Exchange’s most recent estimate of 43 million metric tons. However, soybean production is expected to rebound in 2021/22 with Post estimating output at 51.5 million metric tons. The estimates were included in the FAS Oilseeds and Products Annual report. The USDA will give its first official estimates for 2021/22 production in the May 12 Supply and Demand (WASDE) report.

One big question right now is whether 2020/21 production could see even further cuts ahead. Keep in mind, Argentina has two soybean crops. The first soybean crop is traditionally planted in late October and early November, then harvested in March and April. The second crop is planted in late November and early December, immediately following the winter crop harvest, and then harvested late April through early June.

FAS Buenos Aires says recent cuts stem from a lack of precipitation in February and March which heavily impacted yields in large parts of Buenos Aires and Entre Rios. Outside the main growing regions, too much rainfall has been a challenge, particularly in the northeast. Still, conditions were favorable in other areas of the main growing regions so Post estimates an overall yield reduction of around -10%. Post doesn’t expect any recovery from the damage already inflicted but timely rains likely capped the yield losses in the biggest production states.

There is still the potential for further losses to materialize throughout harvest, though. According to the Buenos Aires Exchange, as of April 16, 2020, the soybean harvest in Argentina was just 7.2% complete, compared to 37.8% last year and the five-year average of 28.8%. The crop was planted late due to unusual precipitation patterns so developmental delays are being blamed for much of the slow harvest pace. The Buenos Aires Exchange says early planted beans are about 86% mature while later planted soybeans are 40% mature. Heavy rains are currently hindering field operations across much of the country, too. Only 9% of the crop is rated good/excellent, with 61% rated fair, and 30% rated poor/very poor.

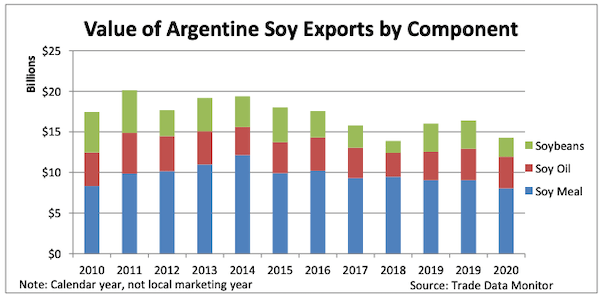

Tucked into FAS’s annual report were some really interesting revisions and updates about the country’s actual crush numbers. For those not familiar with Argentina’s soybean industry, it’s important to understand that the country plays an outsized role in the meal and oil markets. Unlike the U.S. and Brazil, which export most of their soybeans unprocessed, nearly all of Argentina’s production goes to the crush market. While it has accounted for only around 13% of soybean production in recent years, it was responsible for 41% of global soymeal exports and 45% of global soyoil exports in 2019/20.

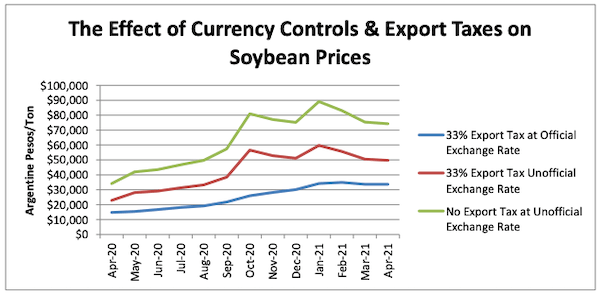

Post revised 2019/20 soybean crush downward by about -100,000 metric tons to 37.6 million, which slightly reduces meal and oil production. As Post explains, for much of the marketing year, soybean buyers have struggled to persuade farmers to sell soybeans, as farmers chose to retain soybeans as a hedge against inflation. As a result, Argentina came into 20/21 with near-record stocks of soybeans and producers have been even slower to sell this year. Argentine farmers have sold 14.37 million metric tons of 2020/21 soybeans, a figure that lags last year’s sales tempo, according to the country’s Agriculture Ministry in data through April 14.

FAS Buenos Aires estimates soybean crush will reach 41.5 million metric tons, a +10% increase from 19/20. That includes soymeal production of 31.4 million metric tons and soyoil output of 8.3 million, which compares to the five-year averages of 31.5 million and 7.9 million respectively. Post’s outlook is based on ample supplies available for crushers but they do note that it’s only achievable if farmers continue selling beans beyond initial harvest sales in mid-July. The government is attempting to spur soybean selling with new financing laws that put preconditions on farmers seeking subsidized loan rates. Farmers or businesses holding significant wheat or soy stocks won’t qualify for the more favorable rates.

Looking ahead to 2021/22, Post only forecasts a +1% rise in total crush at 42 million metric tons. However, they note that Argentina has been in talks with China to provide more pork for the Chinese market, with Chinese investment supporting expansion of the industry. If such plans were realized, they could begin to significantly raise the domestic consumption of soybean meal in future years, which in turn would mean a reduction in Argentine soymeal supplies on the export market. Unless of course the country dramatically increases soybean production, but that’s a subject for another day!