Financially settled Brazilian Soybean futures could soon have a more precise tool to manage exposure to the Brazilian market. I’m told Chicago-based CME Group Inc. plans to start a Brazilian soybean futures contract with the country’s B3 exchange, and it is hoped to help hedge as the global flow of beans continues to shift and evolve. I should mention, this new price discovery tool will represent the export price at Brazil’s port of Santos and be settled in U.S. dollars to the Platts index.

It will take some time to determine the demand for the new contract. For Brazilian producers, the contract could certainly open more opportunities as it would lessen some of the direct deals the country makes with top importer China. Keep in mind, with no physical liquidation on the new contract, it could bring more speculators into play as well.

I’m told the contract will boost spread trading between CME Group Soybean contracts in North America and Brazil and will be available for trade on CME Globex or through block trades on CME ClearPort. It is also hoped it will better reflect fundamentals relative to soy production in Brazil.

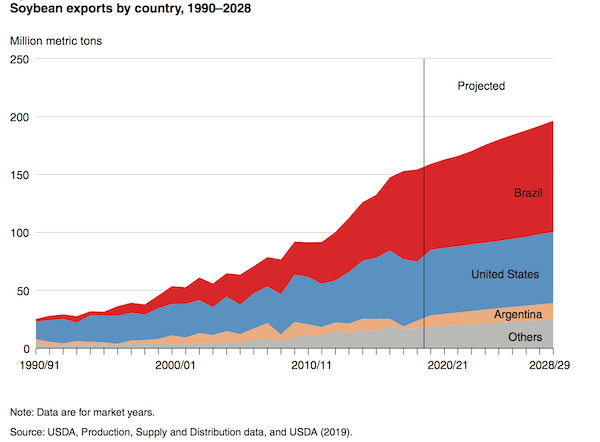

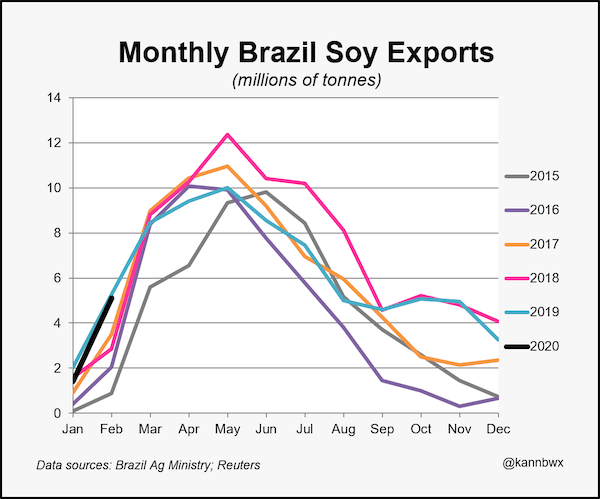

Let’s also keep in mind, since 2013 Brazil continues to be the top global exporter of soybeans. The ongoing trade tensions between the U.S. and China has also pushed more Chinese buyers to Brazilian supplies, arguably leading to some price dislocations that have also boosted the need for an additional hedging tool like this.

Insiders are saying if all regulatory approvals are met, the new contract could launch this fall and extend the CME’s suite of cash-settled products, which also includes Black Sea wheat, corn and Ukrainian sunflower oil. It certainly looks like cash-settled contracts are gaining popularity as agriculture more closely follows the path of energy markets, where thousands of contracts are already based on assessments from price-reporting agencies. Again in life, the one constant is “change”. Personally, I’m most interested in the spread trading that could come along with the new South American contract. (Source: CME, agriculture.com, grainnet)