Farmers National Company (FNC) sees 2023’s sharp increase in land values slowing in this year but expects the values built over the last three years will be maintained. That’s despite increasing pressure from multiple factors, including declining commodity markets, rising interest rates, and inflation.

FNC says despite the negative pressures, buyer demand remains strong for good quality cropland across the Midwest, while the supply of land for sale remains limited. “These factors further play into the dynamics of the supply/demand scenario and remain a large factor in supporting current values in early 2024,” said Paul Schadegg, FNC’s senior vice president of real estate operations.

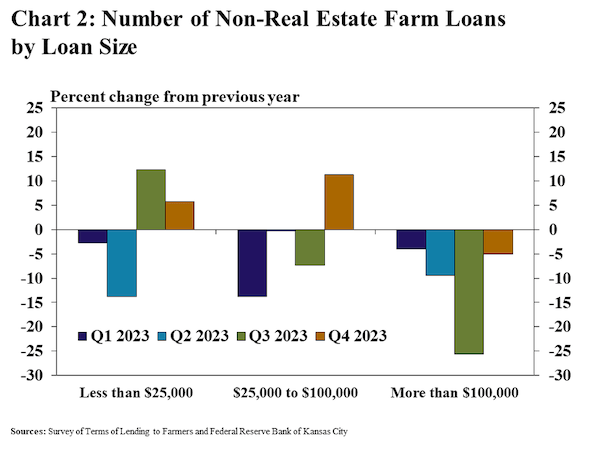

It’s worth noting that the Kansas City Federal Reserve Bank in a recent update warned that higher interest costs could dampen demand for farmland. According to the bank, interest costs in 2023 on new farmland loans surpassed the recent average annual appreciation in land values for the first time since 2001.

According to the KC Fed, “With interest costs now above average land value appreciation, farm operating profits will determine the magnitude of returns for financed land. Although growth in farmland values held firm in 2023, higher interest rates and a moderation in agricultural commodity prices have cut potential returns and could dampen demand for farmland—and thus farmland values—going forward.”

FCN’s Scadegg says that “market operator’s equity positions have narrowed over the past year and lending has increased” and agrees that added interest expenses will cut into potential net farm income in the coming year for farm operators. Scadegg also notes that successful farmland buyers continue to be local farmer/operators in nearly 80% of transactions, and available cash has played a significant role in how aggressive buyers are able to bid.

Overall, FNC staff saw across all its trade regions saw land values over the past six months hold strong at values levels set during the past year. Real estate activity, values, and expectations vary across these regions but overall are experiencing stable land values that are expected to continue into 2024,” Schadegg said. The full report is HERE. Below are some of the regional details:

East Region – Indiana, Ohio, Michigan, Kentucky: Most areas of the region have held strong for high quality land with some slight weakening of properties with lower tillable acres or soil quality. Location and competition often drive sales as was the case at a Farmers National Company auction in August in St. Clair County, Illinois, which brought $18,000 per acre on 120.49 acres of quality soils located on the edge of Bellville, Illinois. An early summer auction of 80 acres in Gibson County, Indiana, of a medium quality farm brought a strong sales price of $13,400 per acre, according to Jay Van Gorden, Area Sales Manager for Farmers National Company’s Eastern Region.

East Central Region – Illinois and Wisconsin: Land sale values have reached a plateau since late last summer 2023, according to Nick , Farmers National Company Area Vice President for the East-Central Region. “Many farms are still being sold at historically strong levels; however, record breaking sales are now few and far between. We’ve seen several auction ‘no-sales’ over the past few months, which is a sign that seller and buyer expectations are not aligning quite as well as they were previously,” Westgerdes said. He adds that the number of land sales as a whole in Illinois for 2023 was down roughly -35% compared to that of 2022.

Central Region – Iowa: This area again saw heavy volume in the second half of 2023, said Tom Shutter, Farmers National Company Area Sales Manager. After lighter volume in the beginning of the year, Farmers National Company has seen a cyclical pickup in farm sales pre- and post-harvest, with the majority of those sales occurring in November and December. “Many land investors are looking at a stock market that continues to break new records, strong returns in money markets and with cash grain prices down nearly $2 per bushel, buyers are cautious about overspending on a particular piece of property. Despite all of this, there is still a fair amount of land that will hit the market before spring planting and we do expect the demand for the high-quality land to remain strong into the foreseeable future,” Shutter said.

Southern Region – Texas, Oklahoma and Arkansas: Demand for quality cropland, ranchland and forestry acreage remains strong in the southern region. However, listings are limited, noted Tyler Ambrose, Farmers National Company Assistant Area Vice President for the Southern Region.

South Central Region – Kansas, Eastern Colorado and Western Missouri: Steve Morgan, Farmers National Company Area Sales Manager for the South-Central Region, said his region continued to see real estate prices flattening across Kansas, western Missouri, eastern Colorado and south-central Nebraska. Morgan says that high quality crop land was still selling for a premium but average to below average crop land has experienced price softening.

Western Region – Western Nebraska, Northwest Kansas and Northeastern Colorado: In western Nebraska, northwest Kansas and northeast Colorado over the past six months, the agricultural land market has shown mixed trends. High-quality farmland sales remain strong, maintaining high prices. However, lower quality land or land with inherent issues has been slightly discounted, said Farmers National Company Area Sales Manager Cole Nickerson. He also notes that pastureland sales are strong, buoyed by higher cattle prices. “Despite this, the market has faced challenges due to rising interest rates and reduced profitability for farmers. These factors have slowed down the market’s growth compared to the record increases seen in recent years,” adds Nickerson.

West Central Region – Eastern Nebraska and Western Iowa: Land values in eastern Nebraska and western Iowa for the most part have stayed steady, according to Chanda Scheuring, Farmers National Company Area Sales Manager. Scheuring notes that while there has been plenty of conversations in the agriculture community surrounding the rise of interest rates over the past year and how this may soften the market, “there still seems to be plenty of cash buyers willing and able to add to their land portfolios at current values.”

Northern Regions – Dakotas and Western Minnesota: Considering the reduced amount of land available for sale, Troy Swee, Farmers National Company Area Sales Manager for the Dakotas expects land values to hold steady as the industry moves into the spring of 2024. “Land may have peaked in the fall of 2022; however, it is still a great time to sell your property and our auctions are still very well attended by both local farmers and investors,” Swee said.