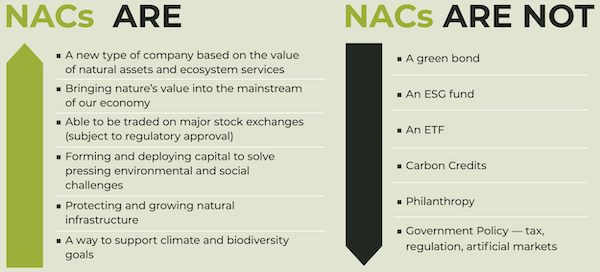

A new type of company could be allowed to list on the New York Stock Exchange starting next year. Known as “natural asset companies,” the Securities and Exchange Commission is currently considering a proposal for the asset type submitted by the NYSE and Intrinsic Exchange Group, a private firm that developed the idea. The proposal has drawn support from environmental groups and some in the financial industry. Critics, however, worry the proposal could be a “back-door approach” to regulating land use.

According to the Intrinsic Exchange Group, which pioneered the natural asset company (NAC) concept and advises public sector and private landowners on the creation of NACs, “by taking a NAC public through an IPO, the market transaction will succeed in converting the long-understood—but to-date unpriced—value of nature into financial capital.” Basically, NAC’s assign value to the services provided by nature, rather than to the extraction of natural resources.

Under the NYSE’s proposal, NACs will hold the rights to “ecosystem services,” or the benefits people receive from nature, such as food, pollination, tourism, or clean water. Each NAC will issue an IPO tied to a specific tangible asset, such as a rainforest, a marine ecosystem or farmland. The proceeds will be used to manage the property to enhance ecosystem services.

At the same time, the proposed rules would prohibit certain activities deemed to have adverse impacts to the natural assets, such as mining, logging, drilling, and farming. As for farmland, NACs Natural asset companies would be allowed to produce “regenerative food crops,” but would be delisted for “perpetuating industrial agriculture.”

Some states are already raising alarms about the proposal. In a recent letter to the SEC, the governors of Idaho, Montana, Nevada, and Wyoming called it a “back-door approach” to regulating land use. Utah State Treasurer Marlo Oaks in a Wall Street Journal op-ed notes that both private and public land is eligible for a NAC to purchase. “If NACs market themselves successfully, a significant amount of land will be removed from productive use,” says Oaks.

Oaks further warns that the effect could be devastating to rural communities in western states like Utah. “Rural communities in the West, deprived of property tax revenue on vast federal land, pay for public improvements primarily through levies from extracting minerals on state land. Noting that federal government has long fought the purchase of public land by private parties, Oaks calls the SEC proposal “a dramatic change in policy.” The SEC’s new framework for NACs is HERE. (Sources: Capital Press, The Wall Street Journal, Real Clear Markets, Cooley PubCo.)