More than a decade ago, the Federal Aviation Administration set a goal for US airlines to use 1 billion gallons of sustainable aviation fuel annually by 2018. The Biden administration upped the target in 2021 to 3 billion gallons per year by 2030. Last year, US production reached just 15.8 million gallons, less than 0.1% of the total fuel consumed by US airlines. However, airlines are now rushing to secure supplies of greener fuels thanks to the goal set by the International Air Transport Association (IATA) in 2021 for the global transport industry to have net-zero emissions by 2050.

Current estimates expect SAF to account for 65% of the mitigation needed to meet the IATA’s goal, requiring a production capacity of 119 billion gallons annually in 2050. IATA estimates just over 79 million gallons of SAF were produced globally in 2022 and the agency says “airlines used every drop, even at very high prices.” Willie Walsh, IATA’s Director General, notes that if more was available, it would have been purchased. Already, airlines have signed forward supply agreements with existing and future SAF producers to utilize billions of gallons of these fuels.

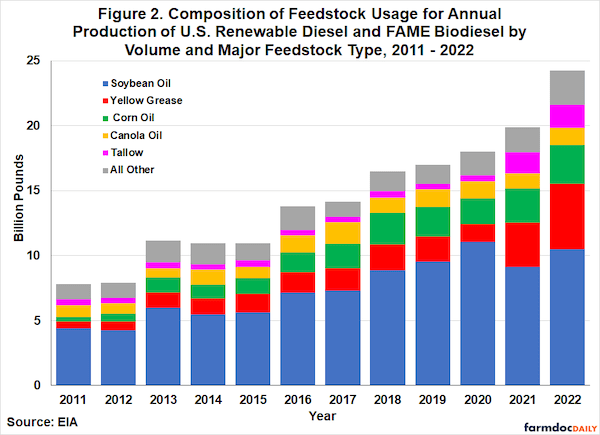

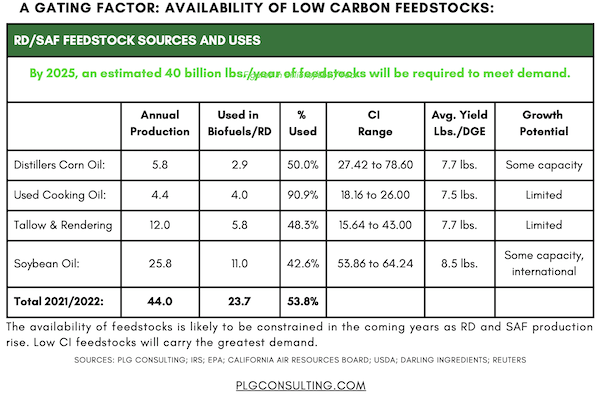

Sustainable aviation fuel, like renewable diesel, can be made from nearly any biomass feedstock but vegetable oils are the most common. Meaning both fuels are competing for the same limited feedstock supplies.

According to analysis by the USDA’s Economic Research Service and University of Illinois, total feedstock usage for the production of biodiesel and renewable diesel surged to over +24 billion pounds in 2022, an increase of +72% since 2017. Total feedstock usage grew over five billion pounds in 2022 alone. As for feedstock use in SAF production, a study by the IEA and Energy Transitions Commission calculated that biogenic (plant-based) feedstocks will only be able to deliver about half of SAF requirements by 2050.

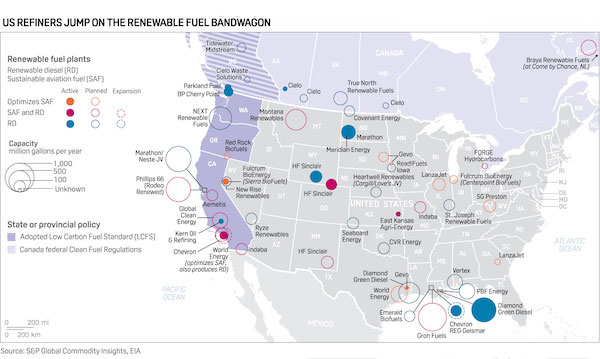

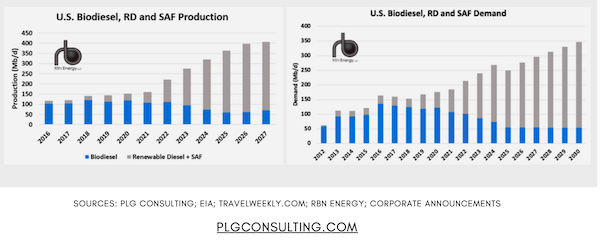

EIA estimates US renewable diesel production capacity was 170,000 barrels per day (b/d), or 2.6 billion gallons per year (gal/y), at the end of 2022. Although the agency anticipates some announced projects will be delayed or canceled, if all projects begin operations as scheduled, US renewable diesel production capacity could reach 384,000 b/d, or 5.9 billion gal/y, by the end of 2025, more than doubling the demand for feedstock supplies for renewable diesel alone.

Aside from competing for feedstocks, another issue for renewable diesel production boils down to credits. President Biden’s Inflation Reduction Act (IRA) of 2022 extended second-generation biofuel tax credits until the end of 2024. This includes a $1-per-gallon biodiesel tax credit for blending of biodiesel, renewable diesel, and sustainable aviation fuel. At the same time, Congress in 2022 created a stand-alone tax credit of $1.25 per gallon for jet fuel blended with a percentage of SAF, increasing SAF credit values over that of other renewable fuels.

Refineries that make biofuels are increasingly designed so they can switch back and forth between different fuel types, allowing the plants to respond to changing market conditions. Based in large part to the new incentive structures, many renewable diesel projects are now altering production to include SAF. According to S&P Global estimates, much of US SAF production is due online in 2025. (Sources: EIA, Farmdocdaily, PLGConsulting, Platts)