The USDA’s Economic Research Service has just launched the 2022 edition of “America’s Farms and Ranches at a Glance”, which primarily focuses on the “family farm,” or any farm where the majority of the business is owned by the principal operator and persons related to them. USDA defines a farm as any place that, during a given year, produced, and sold—or normally would have produced and sold—at least $1,000 of agricultural products. Farm size is measured by gross cash farm income (GCFI), a measure of the farm’s revenue including sales of crops and livestock, government payments, and other farm-related income, including fees received by operators from production contracts. The full report is available HERE. Keep in mind, most of the analysis in the report is based on the 2021 Agricultural Resource Management Survey (ARMS). Also be aware that the new report replaces the annual “America’s Diverse Family Farms” report. Below are some of the highlights:

Small Family Farms Account For 89% of All US Farms

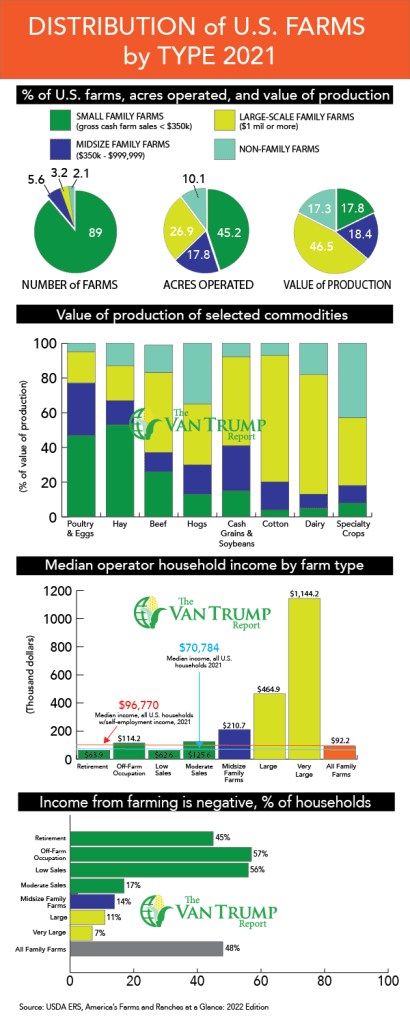

- Most US farms – a full 89% – are what is considered “small family farms” which have gross cash farm income (CGFI) of less than $350,000 annually. These are broken down into three categories: Retirement farms (principal operator has retired from farming), Off-farm-occupation farms (principal operator’s prime occupation is not farming), and farming-occupation farms (farming is primary occupation). These farms operate on 45% of US agricultural land and account for 18% of the total value of production.

- Large-scale family farms (GCFI of $1,000,000 or more) accounted for 46% of the total value of production and 27% of agricultural land in 2021. Midsize family farms (GCFI between $350,000 and $999,999) accounted for 18% of agricultural land and 18% of the total value of production.

- In total, family farms accounted for about 98% of total farms and 83% of total production in 2021.

- Farms where any operator and any individuals related to them do not own a majority (50%) of the business, classified as nonfamily farms, accounted for the remaining 2% of US farms in 2021. Although the percentage of nonfamily farms has remained the same from 2020 to 2021, the value of production increased from 13% in 2020 to 17% in 2021. Large-scale nonfamily farms accounted for 93% of all nonfamily farms’ production.

- The total number of farms in the US in 2021 was 2,003.754. Agricultural acres operated in 2021 was 875.8 million, and the total value of production was $407.5 billion.

Large-scale Family Farms Produce the Majority of Many Key Commodities

- Large-scale family farms produced most of the values of cotton (73%), dairy (69%), and cash grains and soybeans (51%) in 2021. Meanwhile, small family farms produced the majority of hay (53%).

- The percentage of specialty crops nonfamily farms produced increased to 43% in 2021 from 27% in 2020. Specialty crops is a broad term that includes fresh or dried fruits, tree nuts, vegetables, beans (pulses), and horticulture nursery crops.

- Small family farms produced 47% of US poultry and egg output in 2021. Most poultry production is done under production contracts, with a contractor paying a fee to a farmer who raises poultry to maturity.

- Midsize and Large-scale family farms combined accounted for about 57% of beef production in 2021 while the share for small family farms was 26%. Small family farms generally have cow/calf operations, while large-scale family farms are more likely to operate feedlots.

- In 2021, about 35% of hog production was raised by nonfamily farms, an increase from about 15% in 2020.

- Nonfamily farms’ share of dairy production also witnessed a big increased from 8% in 2020 to 18% in 2021.

Most Small Family Farms Have an Operating Profit Margin of Less Than 10%

- The Operating Profit Margin (OPM)—the share of gross income that is profit—is one way to gauge a farm’s financial performance. The lower the OPM, the higher the risk of financial problems. It’s important to note that income from off-farm sources is not reflected in USDA’s OPM calculations. Many retirement, off-farm occupation, and low-sales farm households earn little from farming, with the majority of the farms’ income coming from off-farm sources. OPM ratios are not calculated for operations with zero or negative gross farm income.

- In 2021, between 50% and 81% of small family farms—depending on the farm type—had an OPM in the high-risk (red) zone (less than 10% OPM).

- Large family farms were most likely to have OPMs in the low-risk (green) zone (OPM of at least 25%)— at 54%—and least likely to be in the high-risk zone in 2021. These farms are more likely to have positive on-farm income.

- Farms in the medium-risk (yellow) zone (OPM greater than or equal to 10% but less than or equal to 25%) ranged from 5% to 32%. For each farm type, except very large family farms, the percentage of farms in the medium-risk zone was smaller than the percentages of high- and low-risk farms.

- Compared with 2020, the percentage of farms in the low-risk zone for each farm type, except retirement farms, increased in 2021.

Retirement and Off-Farm Occupation Farms at Highest Risk for Short-Term Loan Default

- The current ratio—current assets divided by current debt—is another measure of financial performance. The ratio indicates if an operation has enough current assets to meet short-term debt obligations. A current ratio of less than 1 suggests the farm is not able to fulfill its current debt by selling its current assets. With the exception of retirement farms, the majority of all farm type categories are not at risk of short-term liquidly issues. USDA notes that an operation could be in the high-risk OPM category because unsold commodity inventories are excluded from the OPM calculation but included in the current ratio calculation.

- Although 71% of all farms had an OPM in the high-risk zone, the majority (57%) of farms had a current ratio greater than 1, meaning the farms could pay their short-term debt, given the value of the operation’s current assets in 2021.

- In 2021, 52% and 47% of retirement and off-farm occupation farms, respectively, had the highest percentage of farms with a current ratio of less than 1 and might be potentially at risk for short-term loan default. However, the current ratio does not account for off-farm household income, which many of these farms could use to fulfill short-term farm debt obligations instead of using income derived from selling agricultural commodities.

- Moderate, midsize, and large-scale family farms (with a current ratio greater than or equal to 1) ranged from 75% to 76%. Therefore, about 23% to 25%of these farms are at risk of defaulting on short-term loans, which is lower than or equal to the percentage in the high-risk OPM zone.

Family Farm Income and Wealth Was Greater Than the Median of All US Households

- As in previous years, the median total income of all U.S. family farm households ($92,239) was greater than the median income of all U.S. households ($70,784) in 2021. Additionally, the median total household income for all family farms in 2021 increased from $80,060 in 2020.

- Median total farm household annual income varied across farm types, with very large family farms having the largest median income at more than $1 million, compared with low-sales family farms at

- $62,624. Low-sales and retirement farms ($63,900) had median household incomes below all U.S. households ($70,784) and the median among U.S. households with self-employment income ($96,770).

- The percentage of family farms with income below the U.S. median-income level varied from 8% to 56%, depending on the type of farm.

- Most family farms also have higher wealth than the median household in the United States. The share of family farms that have wealth below the median held by all U.S. households ranged from almost 2% to 4%, depending on the type of farm. The value of land comprises the largest share of most farm households’ wealth.

- Operators of small family farms—especially retirement, off-farm occupation, and low-sales farms—often reported losses from farming. In 2021, the average farm income among off-farm occupation farms was –$315 and low-sales farms was –$334. Retirement farm households reported an average farm income of $5,052 in 2021.