I’ve heard a lot of talk the past few weeks about the amount of rare earth elements, metals, and traditional energy that are controlled by both China and Russia. Below is an elementary overview and why we should be paying attention and learning more as it may impact our longer-term investments. (Source: Visual Capitalist Elements – By Govind Bhutada; Bruno Venditti; Graphics/Design: Pernia Jamshed; Clayton Wadsworth)

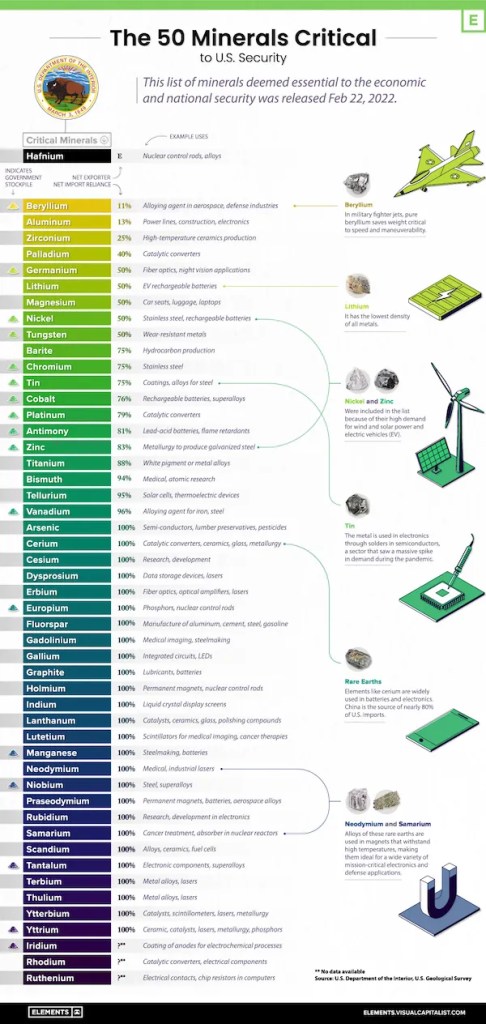

What are Rare Earth Elements? The rare earth elements (REE) are a set of seventeen metallic elements. These include the fifteen lanthanides on the periodic table plus scandium and yttrium.

Why are Rare Earths so Important? Rare-earth elements (REE) are necessary components of more than 200 products across a wide range of applications, especially high-tech consumer products, such as cellular telephones, computer hard drives, electric and hybrid vehicles, and flat-screen monitors and televisions. Significant defense applications include electronic displays, guidance systems, lasers, and radar and sonar systems. Although the amount of REE used in a product may not be a significant part of that product by weight, value, or volume, the REE can be necessary for the device to function, i.e. without them, the spindle motors and voice coils of desktops and laptops would not be possible. Bottom line, Rare earth elements (REEs) are crucial for the production of clean energy, electric vehicles, consumer electronics, national defense, etc… Keep in mind, the typical F-35 fighter contains nearly 1,000 pounds of rare earths.

Who are the Largest Rare Earth Producers? China has the highest reserves of rare earth minerals at 44 million MT. The country was also the world’s leading rare earths producer in 2020 by a long shot, putting out 140,000 MT. Russia was second in production in 2020 with 2,700 MT of rare earths, more than double that of Brazil and Vietnam who were next on the list. The United States used to be a large producer of REEs, but Chinese REE producers gradually drove U.S. mines out of business; China now controls more than +80% of world production and dominates nearly every stage of the global REE supply chain.

What about Nickel? The price of nickel spiked more than +60% yesterday, its biggest gain ever. Even though nickel is not considered a rare earth element it is another critical component for electric vehicle manufacturers, clean energy, etc… The concern is Russia is one of the world’s biggest suppliers of the metal, and the fear of sanctions or the inability to ship the metal has the market very worried about future growth with companies that rely on and desperately need nickel. Russia supplies about 6% of global supply. Yet its importance to the battery industry is much higher. Russia’s Nornickel was the world’s top nickel producing company in 2021, accounting for about 7% of global mine production.

Palladium and Platinum: Russia’s Nornickel is the world’s largest producer of palladium and a major producer of platinum. The company accounted for about 40% of global palladium mine production and 10% of platinum production in 2021. Possible supply outages from Russia are still being priced in on the palladium market. It’s doubtful that supply outages can be offset elsewhere, the market risks sliding into a sizeable supply deficit if the war and sanctions continue.

Aluminum: Russia is home to the world’s largest aluminum producer outside China, United Co. Rusal International. The company accounted for about 6% of estimated global production in 2021. Remember, aluminum is one of the most energy-intensive materials and the surge in oil, natural gas and coal has fed into a comparable rise in the cost of the metal. Energy accounts for about 40% of the production cost. Mostly by coal. So when coal prices move so does aluminum. The price of coal in Australia and Europe has now exploded to roughly $450 a ton versus the normal of $80 a ton. If that is maintained over a longer period of time then aluminum prices could push even higher and higher.

Coal: Russia is the world’s third-largest coal producer. China is Russia’s largest coal buyer, buying over 50 million tons of coal last year, according to Reuters. “Having to replace Russian coal volumes would result in a price shock to global coal markets and a coal shortage in Europe.

Copper: Russia is one of the world’s largest copper producers, and while the price for months has been held back due to worries about Chinese demand, the focus is now turning towards a sanctions-led further tightness in supply.

Iron Ore: Ukraine is home to the world’s largest reserves of commercial-grade iron ore and the fifth-largest exporter of iron ore by volume. Russia is the world’s fourth-largest iron ore exporter.

Crude Oil: Russia is the world’s third-biggest oil producer after the US and Saudi Arabia. It is responsible for about 12% of global oil production, or between 10 and 12 million barrels per day. Around 60% of Russia’s oil exports go to OECD Europe, and 20% to China, the largest single buyer of Russian oil.

Natural Gas: Russia supplies almost half of the European Union’s gas. In 2021, the EU imported 155 billion cubic meters of natural gas from Russia, accounting for around 45% of EU gas imports and close to 40% of its total gas consumption. Germany is heavily reliant on Russian gas, and imports +35% of its gas from Russia.

Lumber: Russia recently surpassed Canada to become the world’s largest exporter of softwood lumber.

What About Neon Gas? Ukraine supplies +50%of the world’s neon gas which is critical for the chip manufacturers. Many companies, including US manufacturers Applied Materials and Intel, have said constraints would persist into 2023. Demand for raw materials is also expected to rise by more than a third in the next four years, as businesses such as the world’s biggest contract chipmaker Taiwan Semiconductor Manufacturing Company tries to increase production. When Russia invaded Crimea in 2014, neon prices shot up by at least 600 percent. Companies have said they can tap into reserves, but the rush to find suppliers that are not in eastern Europe is causing shortages and price hikes, not only of neon but also other industrial gases such as xenon and krypton. It is estimated that +40% percent of the global supply of krypton comes from Ukraine, again another gas essential for semiconductor production.

Bottom line, regardless of your opinion about the war in Ukraine or how US leaders should play their cards involving Russia and China it’s important that we recognize just how reliant many of our US businesses are on the resources that both nations provide. If companies can’t get their hands on rare earth elements or metals that are needed to build batteries or new technologies it seems obvious that growth in the quarters ahead may suffer. There’s just a lot of crazy contagion that we need to be thinking about as the Russian war in Ukraine brings about a very new dynamic and shift in global policy. Just think about the increase in military spending we are going to see in Europe and all the moving parts and pieces that alone will bring about. What direct and indirect impact will the massive sanctions ultimately have on US businesses? How much hotter does this make global inflation?