U.S. corn export prospects in 2021/22 are looking a little brighter even as production in Brazil is set to witness a strong recovery. In its latest Supply and Demand estimates, the USDA lifted U.S. corn exports by +0.5 million tons to 63 million. That’s a pretty dramatic reduction from 2020/21 exports pegged at nearly 70 million but still substantially higher than the 45 million exported in 2019/20.

In Brazil, the lowest corn stockpiles in 7 years are expected to weigh down the country’s 2020/21 exports through February. That marks the end of the 2020/21 local marketing year in Brazil but is 5 months into the 2021/22 export marketing year. The country’s current export pace has been much lower than USDA previously expected. Total 20/21 exports are now pegged at 20 million metric tons, versus 35.23 million in 19/20 and USDA’s initial estimate of 39 million. USDA expects Brazil’s exports will recover and then some in the 21/22 marketing year to reach 43 million metric tons.

Currently, first crop corn planting is underway in Brazil. The first corn crop in Brazil is planted during September-December and harvested in February-May, while the second crop (safrinha) is planted in February-March and harvested in June-July. Brazil’s national agricultural agency Conab currently pegs total corn production at a record 116.31 million metric tons for 2021-22, up more than +33% year on year. That compares to USDA’s current estimate of 118 million metric tons.

USDA had a similarly record-high forecast for 20/21, estimating the Brazilian crop at 110 MMT’s back in December 2020. By September 2021 however, it had slashed that estimate to just 86 MMT’s. A delay in the soybean harvest led to a delay in the planting of the safrinha crop, which always carries the risk of exposing the main Brazilian corn crop to dry-season droughts and early frosts. And those threats did indeed significantly affect 20/21 corn output. Forecasters are currently wondering if the development of La Niña again this year could deliver a repeat of the difficult 20/21 growing season. The weather phenomenon is blamed for overly dry conditions in southern Brazil and above normal rainfall in northern Brazil.

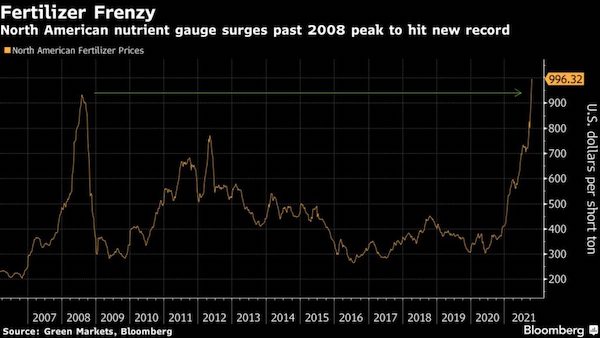

Conab sees Brazil’s 2021/22 corn crop yield rising by +27.7% year-on-year in 2021-22, while total area is seen up +4.7% year-on-year. One major roadblock to achieving that could be input costs, which are substantially higher for producers across the globe this year. While supply chains have increased wait times and costs for machinery, it is the fertilizer that may be the trickiest input to manage amid depleted global supplies and measures by China to limit exports. Brazilian farmers are currently reporting long delays and even cancelations for needed inputs, including fertilizer and herbicide. The country’s Soybean & Corn Producers Association (Aprosoja Brazil) has voiced concerns that the delays and cancelations pose a risk to 21/22 crop output.

Here at home, I’m hearing a lot of similar talk from producers but I’m still not sold on few acres being planted because of the higher prices. If you told me the banks were going to stop lending or reduce the amount they are lending I might agree with the fewer acres, but we all know that’s not going to happen any time soon with the producer’s balance sheet and financial statement recently recharged. I could however see a lot less fertilizer and chemicals being used or thrown at the crop in 2022 so perhaps there will be a chance for greater yield drag and complications. Stay tuned… (Sources: USDA, AgriCensus, FarmProgress)