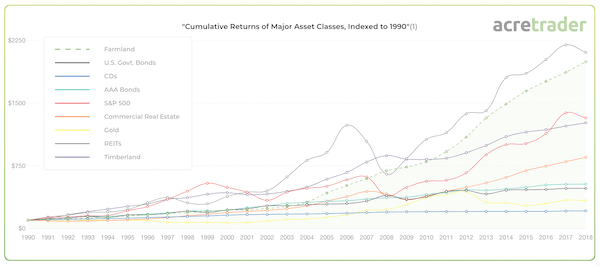

Land is one of the oldest investment classes in existence, producing enormous wealth over generations. In the U.S. farmland represents an attractive, long-term investment while providing significant relative capital preservation during times of economic turmoil. Alongside a rapidly growing global population and demand for food, farmland offers a truly diversified investment opportunity with attractive long-term returns.

A company called AcreTrader is making it easier for investors to access the farmland asset class. The company has created a real estate investing platform that makes it easy to buy shares of farmland and earn passive income. Through a proprietary online investment platform, AcreTrader aims to provide transparency, security, and liquidity for people wanting to invest in farmland.

With a growing global population and shrinking U.S. farmland acreage, the laws of supply and demand are clearly in favor of farmland investing. While farmland investment returns can certainly be negative, we think the historical data shows the exceptional resilience of this asset class. In fact, research has shown, $10,000 invested in a farmland portfolio in 1999 would now be worth +$199,000.

you are invited to attend our seminar titled “Diversity Your Portfolio While Supporting the American Farmer,” a webinar to be held at 3pm CST today June 24th featuring our friend, founder and CEO of Acre Trader, Carter Malloy. We really like Carter and the team he has built. We are excited to see him grow this business. Register HERE to listen and view.