Funding in the Foodtech sector has grown at a +53% compounded annual rate (CAGR) since 2011, according to a new report from global venture capital fund White Star Capital. Deal volume has grown +27% CAGR over the same time period. White Star notes the Foodtech ecosystem is maturing with a large number of IPO and M&A activity. Globally, there are 41 VC-backed Foodtech unicorns coming primarily from the US and Asia (predominantly China). The COVID-19 pandemic has provided strong tailwinds to the sector overall with online food delivery, groceries and D2C prepared meals at the forefront. The full report provides a wide range of insights, including an overview of current venture funding trends and where the money is flowing. The full report is HER.

White Star also provides a sector-by-sector breakdown that includes a “Next-Gen Food” outlook. Examples of next-gen foods include plant-based protein, new forms of food replacements, rethinking of the traditional baby formula, and the use novel ingredients like CBD and fungi. The takeaway – serious investment money is still pouring into these technologies as consumer tastes continue to rapidly evolve. Some of the key details are below:

Food innovation and bio-engineered foods are expected to show massive growth between now and 2025. The largest subsector, driven by consumer concerns around the environmental and health impact of eating meat, is plant-based protein. I also see cell-based protein having huge potential.

North America dominates the market for plant-based meat and dairy in terms of global sales. Western Europe follows with the majority of the sales coming from Germany and the UK. The potential of the addressable market in Western Europe is large, however, only a fraction is capitalized, largely due to the premium perception of plant-based foods.

Plant-based milk and dairy market account for over 69% of the global plant-based food market in 2019. Much of this demand comes from the US and Europe. For example, almond milk has gained considerable share due to the wide-scale popularity among consumers and is expected to grow much more during the next few years.

Cellular agriculture is expected to reach the market by 2022, according to Pitchbook. This sector is likely to become more accessible and will begin to compete with alternative protein when it achieves economies of scale, as the current price of $37 per pound is still too high for most consumers.

Key subsectors in food and next-generation food are meal replacements, plant-based meat and dairy, artificial intelligence (AI), and machine learning (ML) food product and innovation. Significant innovation and R&D has taken place in this sector such as using animal sources to replicate plant-based. However, White Star says costs, regulation, and scale still present obstacles. They also note that large incumbents have started to tap into the plant-based foods market, therefore putting smaller entrants at risk. Some of the trends and challenges:

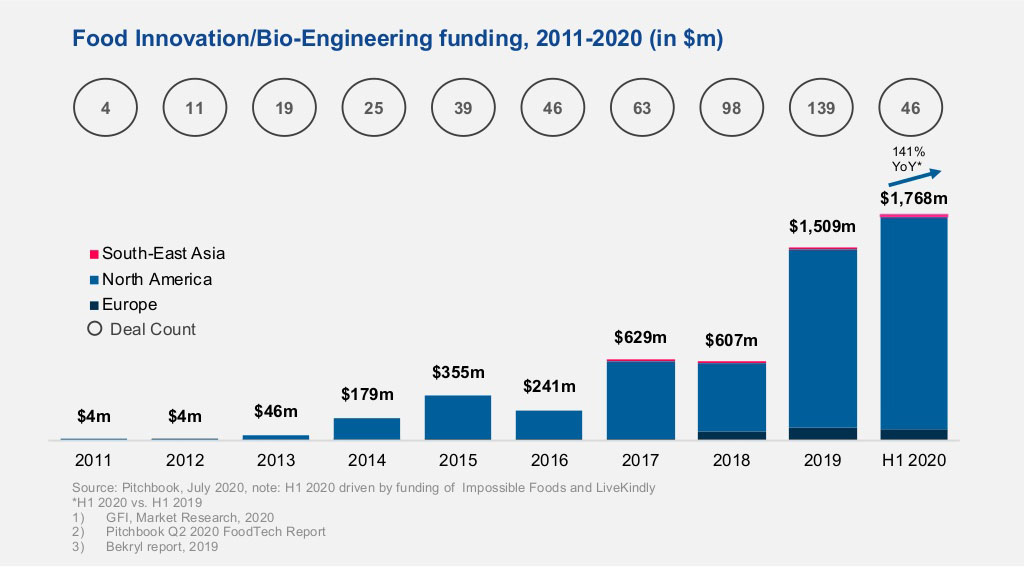

More Venture Capital Flowing That Direction… The plant-based protein market has experienced a permanent shift – in both consumer and corporate openness. Large and small companies are racing to meet surging demand, while VC and CVC fuel their ability to grow. In terms of VC investment, the first half of 2020 accounted for more than the whole of 2019. This was primarily driven by funding of Impossible Foods ($600m) and LiveKindly ($200m).

Big food producers are investing in plant-based protein products. Nine out of the ten largest meat producers in the US have either bought an existing plant-based brand, launched their own, or partnered with plant-based companies. For example, JBS launched a line of plant-based burger called the “Incredible Burger” in 2019 and Tyson Foods has invested in several plant-based companies since 2016.

Fast Food Investing Big Dollars… There has been similar interest in plant-based offerings in the fast-food industry. In the past year, Subway, McDonald’s, Burger King and Pizza Hut (as well as several others) have launched plant-based dishes.

New ingredients have been identified as forms of protein to keep up with the world’s growing population. For example, insects and fungi are good alternatives, relatively quick and cheap to make, compared to mass-market meat production.

New technology has emerged that go way beyond soy and wheat by breaking down the structural components of meat, then turning to the plant kingdom and using computing to find viable replicas that can result in a product that feel, taste and look like meat.

The Real Future Might Be… The process of growing cell-based protein has undertaken significant R&D, however, the cost per pound is still very high. Despite the progress already made, we are still years away from a mass-market product.