Effects of the Covid-19 pandemic can be felt everywhere and agriculture has not been spared. While some of the supply chain issues experienced early on have improved, the most recent updates from regional Federal Reserve districts shows the farm economy remains on shaky ground. Adding to the pressure is drought in some portions of the country which is complicating the picture further for producers in those areas. Below is a more detailed look at the current state of the farm economy from two Fed offices that encompass a majority of the Corn Belt.

The Chicago Fed covers the 7th District which includes Iowa and most of Illinois, Indiana, Michigan, and Wisconsin. Their 2nd quarter AgLetter is available HERE. The Kansas City Fed serves the 10th District, comprised of western Missouri, Nebraska, Kansas, Oklahoma, Wyoming, Colorado, and northern New Mexico. The 10th District Ag Credit Survey is HERE.

Farm Income: Alongside disruptions related to COVID-19, farm income declined at a considerably faster pace in the second quarter. Weak market conditions for key agricultural commodities limited profit opportunities, and farm income dropped at the fastest rate since 2016. Not only were millions of jobs lost, but food consumption patterns were altered—people ate more food at home and less at restaurants and other food service establishments. These changes led to losses of off-farm income (and benefits) for many farm households and a major drop in farm income, as prices for commodities fell. The U.S. Department of Agriculture’s (USDA) June index of prices received by farmers was down -5% from a year earlier.

In response to the pandemic, the government instituted several assistance programs for agriculture – beyond that of the Market Facilitation Program (MFP), which had been designed to deal with lost farm income from shrinking exports. Nearly 95% of respondents throughout the Kansas City Fed District indicated that support from the Coronavirus Food Assistance Program (CFAP) was likely to boost farm income and support credit conditions. As one Illinois banker observed, the “Market Facilitation Program, CFAP, and other farm programs have contributed to stability in spite of low commodity prices.”

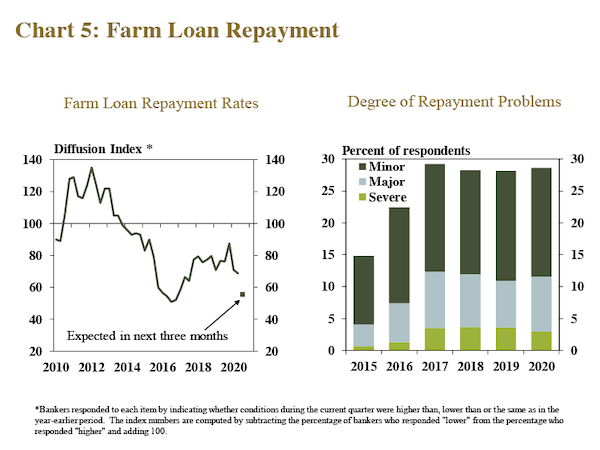

Credit Conditions: Loan repayment was mixed across the two regions in the second quarter. The 10th reported that repayment problems remained steady. Some bankers commented that, although they expected some deterioration in coming months, most concerns related to repayment capacity of farm borrowers remained manageable in the second quarter. Meanwhile, the Chicago Fed said repayment rates for non-real-estate farm loans were lower compared to 2019. The District’s share of farm loans with “major” or “severe” repayment problems, 8.3%, hasn’t been that high since 1988.

Fund availability continued to expand in the Kansas City District, with funds available for financing relative to the previous year the highest since 2013 and likely was supported by a sharp increase in deposits. The pace of growth in new loans and renewals on existing loans slowed slightly compared with the previous quarter. However, renewals and extensions continued to grow at a faster pace than loan demand. Government programs, such as CFAP and PPP, may have reduced the need for traditional financing options

Chicago Fed reports demand for non-real-estate farm loans remained about the same as a year ago. Interestingly, over the first half of 2020, 7th District banks made about their normal amount of agricultural real estate loans, but a higher-than-normal amount of farm operating loans. 26% of survey respondents reported their banks had more funds available to lend in the second quarter of 2020 than a year ago and 7% reporting they had less.

The Kansas City Fed notes that lower farm revenues put downward pressure on liquidity among farm borrowers and additional declines were expected in coming months. The decrease generally was consistent across all states, with a comparably higher share of banks in Nebraska reporting reduced short-term funds among borrowers. Chicago Fed reported credit was again tighter than in the previous year for the second quarter of 2020, as 23% of the ag lenders reported that their banks required larger amounts of collateral than a year ago and none reported that their banks required smaller amounts. Even prior to the pandemic, the USDA had forecast additional declines in working capital for the U.S. farm sector in 2020 and recent developments may put additional pressure on many producers.

Drought: Alongside low commodity prices and COVID-19, drought has placed additional pressure on agricultural credit conditions in the western portion of the Tenth District. Compared with the eastern half of the region, a larger share of bankers further west expected farm borrowers to have more problems repaying loans over the next three months, as concerns of drought have intensified. Most of western Oklahoma and the Mountain States were experiencing some level of drought, and large portions of Colorado were in extreme drought. Consequently, more bankers in the western part of the District reported weaker credit conditions in the second quarter compared with the east, and about 50% expected repayment rates to decline in the next three months.

Farmland Values: All in all, Chicago Fed says farmland values were the same in the second quarter of 2020 as in the first quarter. Yet, there was a year-over-year increase of 1 percent in District agricultural land values. Indiana and Wisconsin had year-over-year increases in their farmland values, while Illinois and Iowa farmland values held steady. Chicago Fed says 79% of responding bankers project no change in farmland values for the third quarter, while 20% project a decrease, and only 1% forecast an increase. In the Tenth District, nonirrigated cropland and ranchland values increased 2.5% and irrigated cropland values remained stable. However, more bankers in the KC Fed District said they expected farmland values to decline in coming months. Although most bankers expected no change in farmland values, only 2% of bankers expected an increase, on average, and 20% expected farmland values to decline.