As (if) drought conditions start to slowly improve and pastures come back, a big question for the beef industry is when the rebuilding of the US cattle herd will begin? So far, there are few signs that producers are holding more heifers back for breeding and many cattle market insiders suspect that herd expansion will take a lot longer than it did following the inventory low hit during the last cattle cycle.

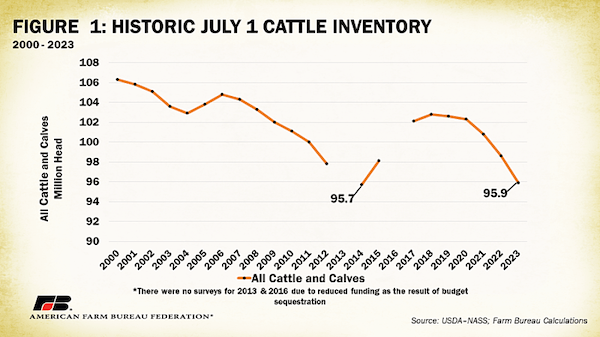

The previous cattle inventory low came amid the 2011-2013 drought that pushed the cattle herd to the smallest since 1952. A 7-year liquidation of the national cattle herd ended on January 1, 2014, at 88.2 million cattle and calves. The cattle herd peaked at 103 million head in July 2020. The USDA’s most recent Cattle Inventory Report report showed all cattle and calves in the US totaled 95.9 million head as of July 1, 2023, down nearly -3% from July 2022. Most think the herd will shrink further before the expansion process begins, though there is still heavy debate as to whether the 2014 low will be avoided.

Several factors are currently influencing cattle producers’ decisions. For one, the impacts of 2 to 3 years of severe drought across key cattle regions are still being felt. According to Lance Zimmerman, senior animal protein analyst with Rabobank’s food and agribusiness section, pastures in areas where the drought has broken still need time to recover. Several key beef regions are actually still suffering under varying degrees of drought, creating a high degree of uncertainty surrounding available forage supplies.

Adding to the worries about feed supplies and costs, hay inventories are still extremely strained. While hay markets won’t really hit peak seasonal demand until fall and early winter, the low supply situation coupled with emerging quality issues is expected to keep costs elevated through the end of the year, at least.

Record high feed and other input costs in 2022 caused significant financial stress for many producers. Industry experts believe many will be inclined to take advantage of higher cattle prices right while they still can and try to recoup some of their losses. At the same time, producers are leery of adding to herds amid so much input price uncertainty.

High interest rates are another issue that may temper the pace of herd expansion compared to the 2014-2019 period, according to Darrell Peel, Oklahoma State University livestock marketing specialist. Higher finance costs will be a much more significant factor as breeding heifer and cow costs rise in the coming months.

David Anderson, Ph.D., Texas A&M AgriLife Extension Service livestock market specialist, says there is little evidence of herd rebuilding right now. Anderson points out that beef heifers held back as cow replacements are the lowest in 50 years, and that number is not expected to increase significantly in 2024. However, Anderson said producers are sending fewer cows to slaughter, indicating the selloff is slowing down, “but we have not turned the corner yet.” (Sources: USDA, Beef Magazine, Feedstuffs, Farm Bureau)