South American soybean production is the subject of intense debate right now with Argentina’s crop withering under ongoing drought conditions while Brazil looks set to deliver a bin-buster. Many were already looking to Brazil’s bumper crop to offset a portion of Argentina’s shortfall but wet weather in some big production states is threatening to dent that crop as well.

According to the latest update from the USDA’s Foreign Agricultural Service (FAS) attaché in Buenos Aires, Argentina’s soybean crop has shriveled to just 36 million metric tons (MMT). That’s -9.5 MMT smaller than USDA’s January estimate of 45.5 million. FAS Post’s update does note that, under perfect growing conditions, it is still possible that the large area planted to second-crop or late-planted soybeans could compensate for losses in first-crop beans. However, a return to high temps and dry conditions could lead to further losses and a crop even smaller than Post currently estimates.

Early planted soybeans were hit hard in the most drought-affected areas of south-central Santa Fe, northern Buenos Aires, and much of Entre Rios, where yields are estimated to be -40% to -75% less than normal. In contrast, parts of southern Buenos Aires, La Pampa, Southern Cordoba, and San Luis, may see average to above-average yields. Importantly, FAS says that much of Argentina’s core soybean growing region shows signs of delayed and stunted development.

FAS says first-crop soybeans in the most important growing region are currently passing through flowering stages (R1-R3) and second-crop soybeans are still in vegetative stages. FAS notes that reduced height and number of branches of first crop soybeans means that relatively fewer nodes are developing than normal. Under optimal conditions, soybeans can compensate for fewer nodes by producing a smaller number of heavier pods and some varieties may reflower to form new pods. However, in the most hard-hit regions, such a recovery is unlikely.

Meanwhile, late-planted or second-crop soybeans have not entered key reproductive stages and still have time to develop. Normally, second-crop soybeans are planted in November and December immediately after harvesting wheat or barley in the same field. However, drought conditions delayed planting significantly and a FAS says higher-than-normal proportion of fields in the core growing area were not planted to any crop.

Ideally, soybeans are planted by January 15 in Argentina’s main soybean growing region as planting after that generally puts crops at greater risk of yield losses and early frosts. According to the Buenos Aires Grain Exchange, Argentine farmers had planted 95.5% of the 2022/23 soybean crop by Thursday, January 18, with only some fields in the northern production areas remaining to be sown.

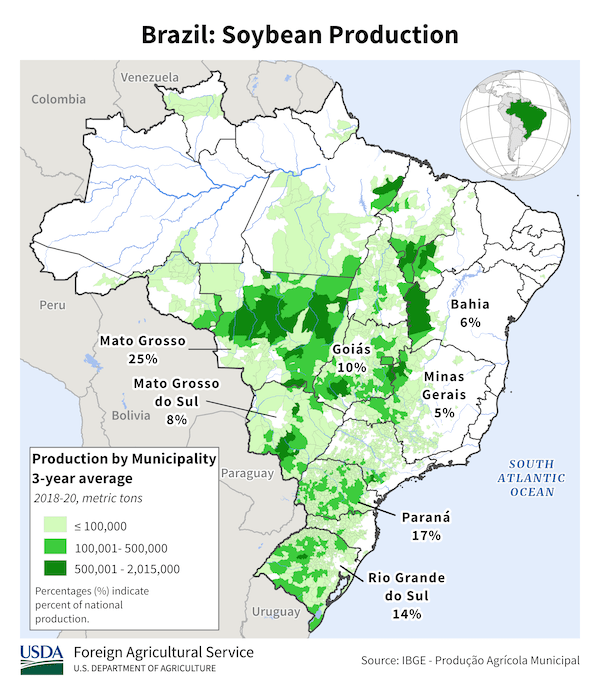

Argentina’s drought conditions stretch into the southern regions of neighboring Brazil, including key production states Parana and Rio Grande do Sul, the country’s #2 and #3 production states, respectively. This has led to concerns about yield potential but most analysts are holding out on any major adjustments as harvest has only just started. Local reports indicate yields are down as much as -30% in Parana while some estimates for losses in Rio Grande do Sul are as high as -40%.

Harvest is most advanced in Brazil’s biggest soybean production state of Mato Grosso where yield reports have been mostly good. However, harvest is running significantly behind at just 13.6% versus nearly 32% last year and the average of around 20%. The delay is the result of wet weather that is now raising concerns about potential quality issues and yield losses if they don’t soon get a break in the wet weather pattern.

USDA officially estimates Brazil’s 2022/23 production at 153 MMT. Combined with the lower FAS production estimate of 36 MMT for Argentina, total soybean output from the two countries would be 189 MMT, which is still more than +15 MMT greater than combined 2021/22 production. (Sources: USDA, Reuters, Mercardo)