Agricultural lender CoBank is forecasting a challenging year ahead for farmers and ranchers as the world economy slows to a crawl. In the US, CoBank expects additional headwinds stemming from the tighter financial conditions, as well as political gridlock in Washington. The authors of the latest forecast, “Forces That Will Shape the U.S. Rural Economy in 2023,” also pinpoint the ongoing US drought and increasing tensions with China as potential downside risks. On the plus side, the future looks bright for biofuels. The full report is HERE. Below are some of the highlights:

Tighter Financial Conditions: CoBank notes that nearly half of surveyed economists are anticipating a US recession in 2023, pessimism that stems largely from the Fed’s monetary tightening campaign. The authors themselves point to the strong US labor market, high consumer spending, and corporate profit margins as buffers against the downward slide but believe these factors will only delay the pain until the second quarter of next year. But given the tightness of the labor market, CoBank believes any recession will be modest. CoBank expects the Fed’s interest rate hikes will also top out at 5.5%, which they note is a bit higher than consensus.

Gridlock in Washington and the Farm Bill: When the 118th Congress opens in January, it will have just nine months to negotiate a new Farm Bill, with the current bill sunsetting on September 30, 2023. This will need to happen in a divided Congress with Republicans controlling the House and Democrats wielding a slim majority in the Senate. CoBank notes that the exact composition of the House remains a big wildcard as it’s still unclear who Republicans will choose as Speaker. In turn, CoBank expects this to slow the organization of the House Ag Committee and other key leaders that participate in the Farm Bill reauthorization process. New members and any departures will have significant influence over the direction of the final bill. The authors note that further divisions will stem from the political divide in Congress, with each party’s area of focus expected to differ significantly. CoBank notes that the Senate will have the upper hand in Farm Bill negotiations.

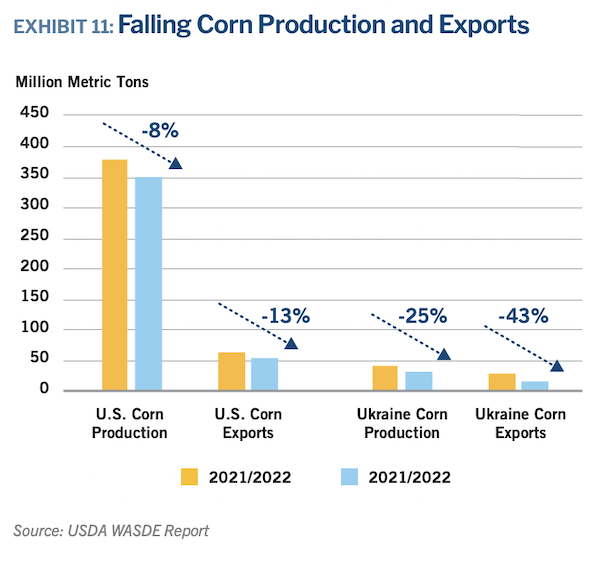

Farm Margins Under Pressure: CoBank anticipates farmers, like other businesses, will begin to feel the strain of numerous headwinds, which include skyrocketing production costs, steeply higher interest rates, an elevated US dollar, and a softer US and world economy. Farmers in much of the Western US additionally face intensifying drought conditions under a third year of La Niña. And US exports are threatened by increasing political tensions between the US and China. CoBank also notes China’s ongoing attempts to reduce its dependence on US ag imports, highlighting Beijing’s recent authorization of Brazil corn imports. The authors anticipate China will assume a “buy only if we have to” attitude toward US imports of not only corn, but also soybeans, meat, poultry, and dairy products. On a positive note, CoBank calls global grain and oilseed supplies “exceedingly tight” which is helping to boost prices. Unfortunately, production cost increases is expected to keep farm profitability near breakeven, at best.

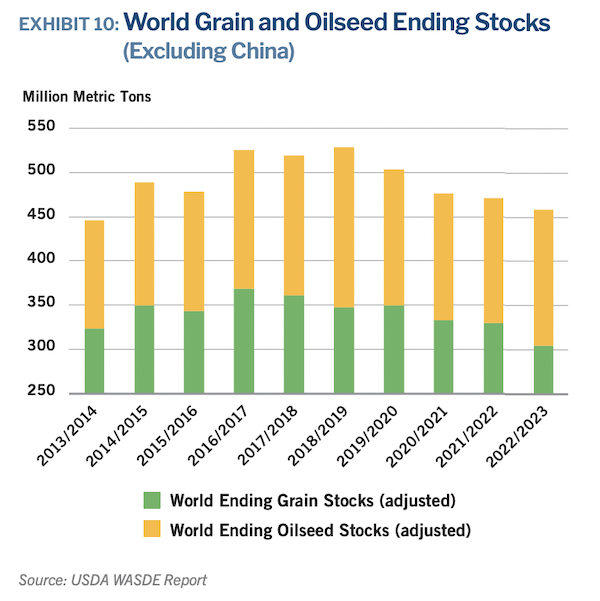

Outlook for Biofuels Solid, Less So for Grain and Farm Supply: CoBank calls the outlook for grain merchandisers in 2023 “mixed.” On the negative side, the fallout from transportation bottlenecks in Q4 2022 as well as a potential GM corn ban by Mexico will present challenges. On the positive side, the authors expect Ukraine grain and oilseed supplies will remain strained for at least the next few years due to the Russia conflict which will provide underlying support for prices and aid US corn exports. CoBank notes that combined global ending stocks for grain and oilseeds have fallen four straight years in a row to their lowest level since 2013/14. They anticipate it will take at least a couple of years to build stocks back to comfortable levels. CoBank’s outlook for biofuels is much more positive, supported by federal policy and demand tailwinds from 2022. Ethanol is expected to benefit from expanding E15 usage, growing demand for corn oil, and strong pricing of carbon dioxide. Additionally, the momentum behind renewable diesel is expected to continue growing as new processing plants come online.

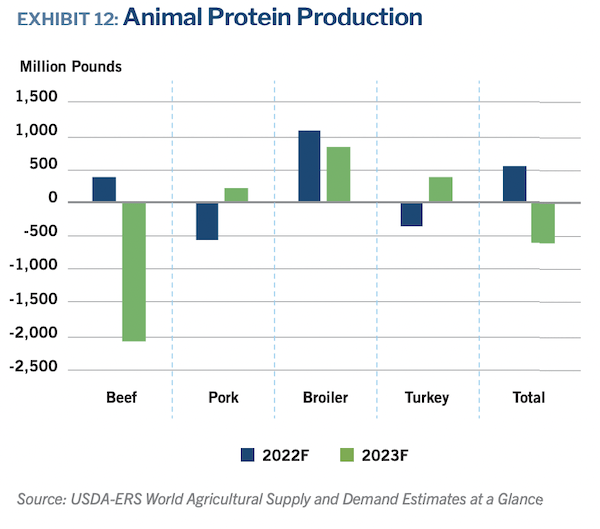

Meat and Poultry Slowdown: CoBank sees the broad-based era of profitability for the meat and poultry sector will come to an end in 2023. High operating costs are seen keeping a lid on industry expansion while consumer budgets will continue to be strained by inflation. CoBank notes a decline in retail grocery sales volume in recent months, which is expected to accelerate in the first half of 2023. After reaching a projected all-time high of more than 226 pounds per capita in 2022, CoBank expects US meat and poultry consumption to be flat in 2023, with marginal gains in chicken and pork offsetting a decline in beef. CoBank expects red meat production will experience a substantial contraction of some 2 billion pounds year-over-year in 2023. This is a reflection of the -5% annual reduction in total beef cow inventory. As a result, prices are seen remaining historically high in both live cattle and beef markets.

CoBank expects a moderate rebound next year for pork production, noting that the hog herd is near a 5-year low down – 6% from the peak in 2020 – which suggests minimal potential for supply growth. The authors also anticipate an increase in US pork imports in order to partially offset the gap in red meat production.

As a result of beef and pork supply constraints, US chicken consumption growth is poised for growth. However, the authors say this will require major integrators to actively boost chick placements and bird weights. As for prices, CoBank does not expect broiler prices to revert to pre-pandemic low levels but also does not believe the record highs witnessed in 2022 will return.