Global corn supplies face a high degree of uncertainty following Russia’s invasion of Ukraine, which is responsible for around 17% of the world’s exports. With Ukraine’s remaining corn exports for this season in question and a likely substantial reduction in plantings later this spring, there is an increasing amount of attention on Brazil’s second corn crop.

Known as “safrinha” corn, the second crop is planted directly after soybeans are harvested, typically in January-March. Safrinha, which means “little harvest” in Portugese, accounts for about 70% of Brazil’s total corn production and three-quarters of the country’s total corn exports. The first crop is usually harvested in February-April and primarily supplies the domestic livestock market. Safrinha harvest typically runs June-August.

This season’s safrinha crop is essentially in the ground and much ahead of last year when weather hiccups delayed the soybean harvest. Later planting increases the risk of the critical yield formation period running up against the country’s dry season. In the central states of Mato Grosso, Goiás, and Minas Gerais, which account for about 60% of safrinha corn production, planting was mostly complete in early March. In most regions, this year’s crop was planted during the ideal planting window and into good conditions, including excellent soil moisture profiles. However, there are growing concerns about a lack of rainfall as the crop progresses.

Rainfall in March has so far been variable and below average in many areas. Deficits of more than 4 inches are being reported in Goiás and Minas Gerais, and 2-4 inches in much of Mato Grosso. According to WeatherTrends360, Goiás and Minas Gerais are on track to have the fourth of fifth driest March on record. Conditions are also said to be unusually dry in the south, including Paraná, the country’s second-biggest producing state. Brazil’s dry season usually begins in early May but could be more intense this year due to the ongoing presence of La Niña. The weather pattern tends to bring an early-end to seasonal rains which could obviously compound existing moisture deficits.

There is also some risk that yields for the safrinha corn will be lower if growers are either unable to source enough fertilizer, or if they elect to use less fertilizer given skyrocketing costs. Brazil is the world’s fourth largest consumer of fertilizers (behind China, India, and the United States) and usually imports about 80% of its fertilizer requirements. Given high input costs, USDA FAS Post recently speculated that safrinha corn profits could be about half last season’s levels.

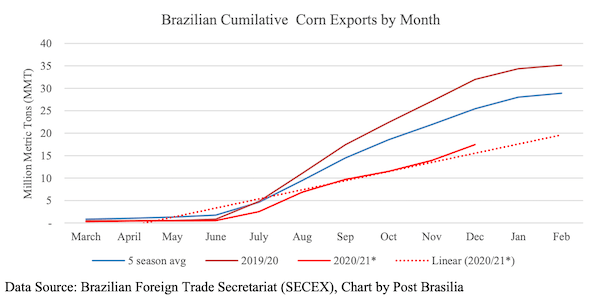

Overall, total safrinha corn production is expected to be much improved from last year, with CONAB estimating output at 86.2 MMT versus just 60.7 MMT in 20/21. First crop corn is estimated at 24.3 MMT, which would put total production at just over 112 MMT, compared to around 87 MMT last year. Second crop output is based on an estimated planted area of 39.5 million acres, though some local agencies say that could end up being even higher thanks to currently higher corn prices. Estimates for total 21/22 exports vary pretty widely. CONAB’s current forecast is 35 MMT, while the USDA is at 43 MMT. Both are a big improvement over last year’s exports, which USDA has pegged at just 21 MMT. (Sources: USDA, Deral, CONAB, Reuters)