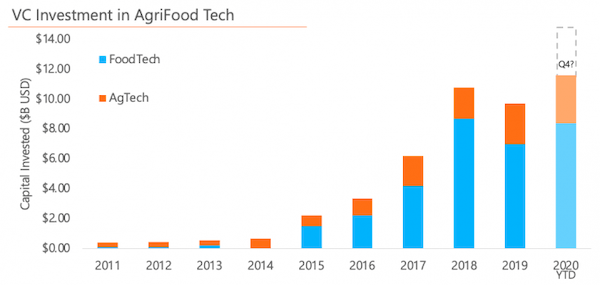

Food technology has been a red hot investment space this year. In the first three quarters, investment in food tech reached $8.37 billion, which handily exceeds the total $7 billion raised in all of 2019. The bulk of capital has flowed to late-stage startups that included some of the year’s biggest deals, including Impossible Foods, Memphis Meats, LiveKindly, and Perfect Day. Overall AgriFood Tech investment came to $11.6 billion in the first three quarters with the AgTech sector’s portion of that hitting $3.07 billion versus the 2019 total of $2.7 billion.

The data comes from a new report from Finistere Ventures, which notes that while AgriFood investment has continued to show strong growth in 2020, there has been strong differences emerging between the B2B focused AgTech, and largely B2C Food tech startups. This is reflected in very different market dynamics especially in scale of revenue, in terms of exits, capital timeframes, and geographically different investor bases. AgTech actually led the broader category both by capital invested, and by exit activity until around 2016 when FoodTech investment began to dramatically increase. The flow of capital is now shifting within the AgriFood market towards later stage and larger deals as it continues to mature. The full report is HERE. Below are a few key details:

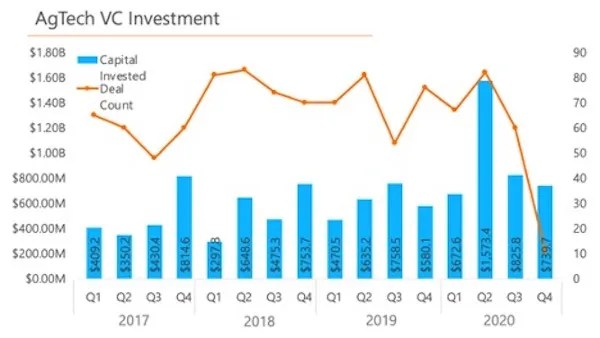

AgTech Investment: The pandemic has seen consumers and investors alike become acutely aware of supply chain and challenges in food production. On the farm, attention has also turned to worker safety and disruption to everyday work, especially in crops where workers are in close proximity. Finistere says these issues have put automation very much on the agenda, as well as areas like indoor farming. The indoor farming segment captured 28% of capital deployed into AgTech (up +40% year on year from 2019) through mega-rounds like those of Plenty ($315M), InFarm ($170M), and Bright Farms ($100M). Finistere says increasing awareness on the impacts of food production on climate change, land-use, and the incidence of pandemics, has increased investment into Crop Protection and Inputs Management companies. Some notable Crop Protection deals include companies like Enko Chem ($45M), GreenLight Bio ($102M), and Pivot Bio ($100M). Animal Health also saw an uptick.

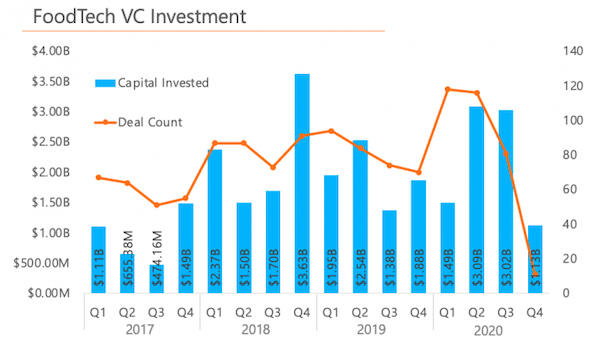

FoodTech Investment: Finistere says consumer demand for convenient access to tastier, healthier, more sustainable and ethically produced food has driven a burst of investment into FoodTech. In 2020, consumer preferences have continued to evolve creating the emergence of a new wave of food companies focused on alternative proteins with better functionality, convenience, novelty and sustainability. Covid also brought a return to dining at home – this is the first year since 1994 that consumers are spending more money on food at home rather than dining out. A key continuing trend has been the rush of investments driven blitzscaling (the deployment of capital to take advantage of growth brought on by network effects) particularly in delivery and online commerce models. Investors are also doubling down on perceived the best-in-class companies, leading to more mega-rounds (financings of $100M+) closed in in H1 2020 than ever before, including those of Rappi ($1B), DoorDash ($700M) and Impossible Foods ($300M).

While FoodTech has experienced a growth in capital deployment, Covid has had an uneven effect on subsets within the sector. Companies focused on the restaurant and foodservice markets have been confronted with lockdowns, and customer retreat. However, start-ups focused on Meal Kit solutions and E-commerce grocery are benefiting, Together, these leading segments within FoodTech captured over 57% of capital deployed in the first three quarters. Supply chain optimization solutions, and platforms that simplify food procurement, preparation, and delivery are also seeing significant growth in a COVID-impacted world. The rise in concern around the impacts of meat production on environmental and human health has continued strong financings into Alternative Protein. These start-ups commanded 31% of capital deployed into FoodTech in 2020, characterized by mega-rounds like those of Memphis Meats ($186.3M), Perfect Day ($300M) and LiveKindly ($335M). Finistere notes that while the first wave of successful alt-protein companies was enabled by first-mover advantage and brand engagement, the next wave will need to show superior product experience, differentiated offers and improving economics especially in fermented and cell-based products.